Flexible Industrial Packaging Market Size, Trends, Segments, Share and Companies 2025-35

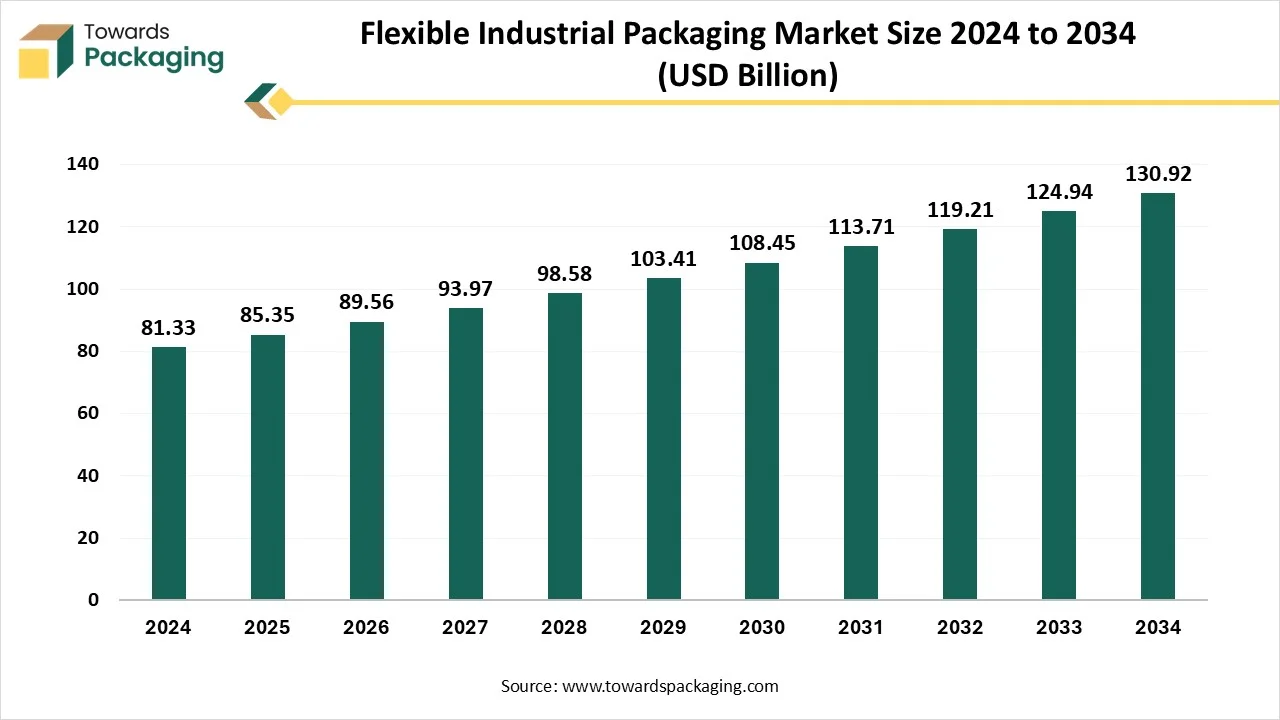

According to Towards Packaging consultants, the global flexible industrial packaging market is projected to reach approximately USD 130.92 billion by 2034, increasing from USD 85.35 billion in 2025, at a CAGR of 4.93% during the forecast period 2025 to 2034.

Ottawa, Nov. 18, 2025 (GLOBE NEWSWIRE) -- The global flexible industrial packaging market stood at USD 85.35 billion in 2025 and is projected to reach USD 130.92 billion by 2034, according to a study published by Towards Packaging, a sister firm of Precedence Research.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Key Insights

- Asia Pacific dominated the flexible industrial packaging market, having the biggest share in 2024.

- North America is expected to rise at a notable CAGR between 2025 and 2034.

- By packaging type, the flexible intermediate bulk containers segment has contributed the largest share in 2024.

- By packaging type, the liner segment will grow at a notable CAGR between 2025 and 2034.

- By material, the plastic segment contributed the largest share in 2024.

- By material, the multi-layer laminates segment will grow at a notable CAGR between 2025 and 2034.

- By capacity, the 501-1000kg segment contributed the largest share in 2024.24.

- By capacity, the above 1501 segment will grow at a notable CAGR between 2025 and 2034.

- By distribution channel, the direct sales segment contributed the largest share in 2024.24.

- By distribution channel, the online channels segment will grow at a notable CAGR between 2025 and 2034.

- By end-use industry, the chemicals and petrochemicals segment has contributed the largest share in 2024.

- By end-use industry, the food & beverage ingredients segment will grow at a notable CAGR between 2025 and 2034.

Key Technological Shifts

| Technological Shift | Description/Impact |

| Biodegradable & Compostable Films | Adoption of eco-friendly materials to reduce environmental impact and meet regulatory sustainability requirements. |

| Barrier & Multi-layer Films | Advanced films enhance product shelf life by providing superior moisture, oxygen, and UV protection. |

| Smart Packaging Technologies | Integration of QR codes, NFC, and sensors for real-time tracking, authentication, and consumer engagement. |

| Lightweight & High Strength Materials | Development of materials that reduce packaging weight while maintaining durability, cutting transportation costs. |

| Flexible Pouches & Stand-up Bags | Innovative designs improve convenience, storage efficiency, and consumer appeal. |

| Recyclable & Mon material Solutions | Simplification of packaging materials to enhance recyclability and align with circular economy goals. |

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5657

Market Overview

The flexible industrial packaging market is witnessing a strong growth, motivated by the growing demand for effective lightweight and environmentally friendly packaging solutions in sectors like chemicals, food and beverage, and pharmaceuticals. Benefits of flexible packaging include easier transportation, improved product protection, and less material consumption. Growing consumer demand for recyclable and eco-friendly products is driving market growth. To satisfy changing industry demands, manufacturers are also experimenting with cutting-edge materials and clever packaging technologies.

Market Outlook

- Industry Growth Overview: The market for flexible industrial packaging is growing quickly as industrialization increases, e-commerce grows, and the demand for long-lasting and reasonably priced packaging options increases. Flexible packaging is becoming more popular than traditional rigid formats, particularly in industries like food, chemicals, and pharmaceuticals.

- Sustainability Trends: Eco-friendly and recyclable materials such as compostable plastics and biodegradable films are becoming increasingly popular. To support global sustainability objectives, businesses are investing in lowering carbon footprints, encouraging reusable packaging, and utilizing renewable resources.

-

Startup Ecosystem: Key investors in this market include large packaging manufacturers, private equity firms, and venture capitalists focusing on sustainable materials and innovative packaging technologies. Notable players actively investing in R&D and capital expansion include Amcor, Sealed Air Corporation, Berry Global, and Mondi Group.

More Insights of Towards Packaging:

- Pharmaceutical Cold Chain Logistics Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape 2025-2035

- PTP Aluminum Foil for Pharmaceutical Package Market Size, Trends, Regional Outlook, Segments Analysis and Competitive Landscape

- Automated E-Commerce Packaging Market Size, Trends & Forecasts (2025-2035) with Regional, Competitive & Trade Analysis

- IV Fluid Bags Market Size, Trends, Segments, Regional Insights & Competitive Landscape 2025-2035

- Plastic Tray Market Size, Trends, Segments, Regional Forecast (NA, EU, APAC, LA, MEA), Company Profiles & Value Chain Analysis

- Tablet Inspection and Printing System Market Size, Trends, Segments, Regional Insights & Supplier Landscape

- Duplex Paper and Board for FMCG Market Size, Trends, Segments, Regional Outlook & Competitive Landscape (2025-2035)

- Molded Tableware Products Market Size, Trends and Regional Insights (North America, Europe, APAC, Latin America, MEA)

- VCI Anti-corrosion Film Market Size, Trends, Competitive Analysis, Segments Data, Regional Insights, and Manufacturers

- Contact Lenses Packaging Market Size, Trends, Forecasts, Segment Analysis, Regional Insights, and Competitive Landscape

- Pharmaceutical Bottles Market Size, Trends, Segmentation, Regional Insights, and Competitive Landscape Analysis

- Veterinary Medicine Packaging Market Size, Trends and Segmental Analysis (2025-2035)

- Diagnostic Test Kits Packaging Market Size, Trends, and Competitive Analysis 2025-2035

- Diagnostic Tools Packaging Market Size, Trends, Regional Insights, Segment Analysis and Leading Manufacturers

-

Pills and Tablets Bottles Market Size, Trends, Growth Strategies and Competitive Benchmarking Across North America, Europe, APAC, and LATAM

Segmental Insights

By Packaging Type

The flexible intermediate bulk containers segment dominated the market due to their excellent load-bearing capacity, affordability, and suitability for the transportation of large quantities of minerals, chemicals, building materials, and agricultural products. Their adoption in large-scale industrial operations is further reinforced by their reusability, lower handling costs, and compatibility with automated filling systems. FIBCs are preferred by industries because they reduce the risk of spills and damage, enhancing operational effectiveness and safety.

The liner segment is growing rapidly in the flexible industrial packaging market as the need for barrier resistance and contamination-free internal packaging solutions grows across industries. By protecting against moisture, oxygen, and chemical exposure, particularly for sensitive materials, liners improve the performance of bulk containers. Adoption is being accelerated by their increasing use in pharmaceutical-grade powders, food ingredients, and specialty chemicals. Rapid growth is being facilitated by the move toward clean, hygienic, and legally compliant storage solutions.

By Material

The plastic segment dominated the market due to cost-effectiveness, robustness, and lightweight design for producing packaging of industrial quality. Strong chemical resistance, superior strength-to-weight ratios, and ease of modability into a variety of industrial formats are all provided by plastic materials. Dominance is further fueled by their reliable performance in harsh settings like construction chemicals and fertilizers. Furthermore, the industry's continued reliance is supported by developments in recyclable plastics.

Multi-layer laminates segment is growing rapidly in the flexible industrial packaging market due to increasing demand for high-barrier, multi-functional packaging that protects goods from moisture, UV light, and contaminants. Industries are adopting these laminates to extend product shelf life, especially for sensitive powders and high-value materials. Their ability to combine strength, insulation, and sustainability in one structure makes them preferred for premium industrial applications. Rising regulatory focus on product safety is further boosting growth.

By Capacity

The 501-1000 kg segment dominated the market because it provides the best possible balance between bulk handling efficiency and portability for industries like construction materials, chemicals, and food ingredients. For optimal loads, this size is frequently utilized in international trade and warehousing operations. It is a universal option for manufacturers and logistics forms since it is compatible with the majority of lifting and stacking systems.

The above 1,501 segment is growing rapidly in the flexible industrial packaging market because of growing demand from large-scale chemical processing facilities, mining operations, and heavy industries that need ultra-high-capacity bulk handling. By lowering the frequency of handling cycles, these large-volume packages save labor and operating expenses. As businesses increase production volumes and demand more effective integrated packaging solutions, their use is growing.

By Distribution Channel

The direct sales segment dominated the market due to the fact that industrial buyers favor direct manufacturer relationships for reliable supply and customized bulk packaging solutions. Customers can request customized specifications, haggle over prices, and get technical assistance through this channel. Direct sales is the most dependable model for large-scale industrial procurement since manufacturers gain from long-term contracts and predictable demand cycles.

The online channels segment is growing rapidly in the flexible industrial packaging market, becoming mainstream across industries. Buyers increasingly prefer online platforms for comparing materials, specifications, and prices quickly. E-commerce-enabled B2B platforms make ordering faster, transparent, and convenient, reducing dependence on intermediaries. The growth of digital catalogs, virtual sampling, and online customer support is fueling accelerated adoption.

By End Use Industry

The chemicals and petrochemicals segment dominated the market because of its enormous need for industrial packaging that is contaminant-free, long-lasting, and highly safe. FIBCs and other flexible packaging formats are perfect for powders, granules, resins, catalysts, and hazardous materials because they provide controlled handling options and strong chemical resistance. Strong and steady demand is still guaranteed by the industry's extensive international trade and stringent regulations.

The food & beverage ingredients segment is growing rapidly as producers switch to hygienic bulk packaging for specialty food formulations, powders, grains, and additives. During long-distance transportation, flexible packaging guarantees product freshness, avoids contamination, and maintains constant quality. Growing demand for packaged nutritional ingredients, export-oriented food processing, and the move toward clean-label production are all contributing to the fast growth.

By Region

Asia Pacific is dominating the market because of its extensive industrial production, robust demand from the building chemical and food processing industries, and growing manufacturing activities focused on exports. The area gains from increasing industrial investments, cost-effective production, and a quickly expanding logistics network that facilitates the transportation of bulk materials. It maintains its top spot thanks to its strong emphasis on high-volume output and ongoing industrial growth.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

India Flexible Industrial Packaging Market Trends

India is emerging as one of the most dynamic markets for the flexible industrial packaging market, propelled by growing food processing and agricultural exports, growing manufacturing, and increased chemical production. Cost effectiveness, rising export volumes, and supply chain modernization are driving the ations rapid transition to bulk handling solutions like FIBCs, liners, and multi-layer packaging. India's status as a high-potential growth hub in the region is being reinforced by growing investments in industrial infrastructure and the growing use of automation-friendly and sustainability-focused packaging formats.

North America is the fastest-growing region as industries are moving more toward flexible packaging solutions that are sophisticated, environmentally friendly, and automation-friendly. The region's emphasis on high-performance materials, stringent quality standards, and contemporary supply chain systems is driving up demand for multi-layer packaging formats, FIBCs, and liners. The market is expanding quickly due to the growing adoption of chemical food ingredients and specialty materials.

U.S. Flexible Industrial Packaging Market Trends

The U.S. is growing rapidly due to strong demand from the chemical, pharmaceutical, food ingredients, and specialty materials industries in this innovation-driven market for flexible industrial packaging. To improve supply chain efficiency, safety, and compliance, he nation is quickly implementing digitally trackable packaging solutions, the heavy-duty FIBCs, and high-barrier laminates.

The market is expanding more quickly thanks to an emphasis on sustainability, automation, and high-quality materials, and the existence of significant manufacturers and valuable industrial applications keeps the U.S. an important factor in the growth of the global market.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Developments

- In November 2025, Amcor plc announced a significant expansion of its North American printing, lamination, and converting capabilities for the protein packaging market. The installation of new state-of-the-art equipment will increase production now through the first half of 2026 and support Amcor's AmPrima recycled ready portfolio in meat, poultry & seafood segments.

- In June 2025, Dow Inc. unveiled its new recyclable packaging resin INNATE TD 220 Precision Packaging Resin aimed at BOPE films and other flexible packaging applications. The resin is designed for high-performance mono material packaging and is already being tested in collaboration with the Chinese laundry brand Liby, integrating 10% post-consumer recycled resin to support circular economy goals.

- In April 2025, Advanced Industries packaging Romania installs a Windmoller & Holscher MIRAFLEX II L8 high-speed printing press, boosting its printing technology to 500m/min and enabling 8 color precision printing. The technology upgrades support the AIP strategic goal to deliver faster, smarter, and high-quality flexible packaging solutions for a variety of end markets.

Top Companies in the Flexible Industrial Packaging Market & Their Offerings:

Tier 1:

- Greif, Inc. Focuses on rigid industrial packaging but has divested its flexible packaging joint venture to concentrate on steel, plastic, and fibre drums.

- Berry Global, Inc. Manufactures a wide range of plastic packaging products, including films, bags, and pouches used across industrial applications.

- LC Packaging Specializes in high-quality, certified Flexible Intermediate Bulk Containers (FIBCs), also known as jumbo bags.

- Mondi Group Offers a diverse range of sustainable, paper-based and plastic-based flexible packaging solutions for industrial and consumer markets.

- Conitex Sonoco Specializes in the manufacture of intermediate bulk containers (IBCs) and bulk bags (FIBCs) for industrial material handling.

- Rishi FIBC Solutions Pvt. Ltd. Specializes in the production of integrated FIBC bags, container liners, and flexitanks for dry bulk and liquid industrial packaging needs.

- Bulk-Pack, Inc. A provider of various bulk bags (FIBCs), offering standard, baffle, and custom-designed bags for industrial dry goods.

- BAG Corp Offers a comprehensive line of FIBCs (bulk bags) and other bulk packaging products for the safe transport of dry flowable materials.

- Emmbi Industries Limited Specializes in the manufacturing of FIBCs, flexible packaging, and various polymer-based products.

- Intertape Polymer Group (IPG) Produces a range of industrial packaging solutions, including woven plastic bags and heavy-duty performance packaging media for bulk handling.

-

Plastipak Holdings, Inc. Primarily specializes in rigid plastic containers for consumer goods and beverages, rather than extensive flexible industrial packaging solutions.

Tier 2:

- AmeriGlobe LLC

- Sackmaker J&HM Dickson Ltd

- Nihon Matai Co., Ltd.

- Glenroy, Inc.

- Huhtamaki Oyj

- Umasree Texplast Pvt. Ltd.

- Greystone Logistics, Inc.

- Boxon GmbH

- Knack Packaging Pvt. Ltd.

- Other Players

Segment Covered in the Report:

By Packaging Type

- Flexible Intermediate Bulk Containers (FIBCs)

- Type A

- Type B

- Type C

- Type D

- Industrial Sacks

- Valve Sacks

- Open Mouth Sacks

- Industrial Bags

- Guessed Bags

- Flat Bottom Bags

- Wrapping Films

- Shrink Wrap

- Stretch Wrap

- Pouches

- Liners

- Drum Liners

- IBC Liners

- Bag-in-box Liners

- Bag-in-Box Systems

- Others

By Material

- Plastic

- Polypropylene (PP)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Others

- Paper

- Aluminum Foil (for liners/pouches)

- Multi-Layer Laminates

- Others (Woven Fabrics, etc.)

By Capacity

- Up to 500 kg

- 501 – 1,000 kg

- 1,001 – 1,500 kg

- Above 1,501 kg

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Channels

By End-use Industry

- Chemicals and Petrochemicals

- Agriculture and Fertilizers

- Construction and Building Materials

- Food and Beverage Ingredients

- Pharmaceuticals and Healthcare

- Mining and Minerals

- Paints, Inks, and Dyes

- Plastics and Resins

- Others (Textiles, etc.)

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Access Now: https://www.towardspackaging.com/contact-us

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5657

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack |Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Syringes and Injectable Drugs Packaging Market Size, Trends and Competitive Landscape

- IC Packaging and Testing Market Size, Trends, Segmentation and Regional Analysis (NA, EU, APAC, LA, MEA)

- Plant-Based Food Bioplastics Market Size, Trends, and Competitive Landscape Analysis (2025-2035)

- Recycled Aluminum Cans Market Size, Trends, Competitive Landscape, and Trade Data (2025-2035)

- Specialty Shipping Containers Market Size, Trends, Forecasts, Segmental & Regional Insights (2025-2035)

- Electronics APET Film Market Size, Trends, and Competitive Landscape Analysis (2025-2035)

- PET VCI Shrink Film Market Size, Trends, and Competitive Analysis (2025-2035)

- Pharmaceutical APET Film Market Size, Trends, and Competitive Analysis (2025-2035)

- Polystyrene (Ps) Plastic Punnets Market Size, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Calcium Plastic Turnover Box Market Size, Trends, Segments and Regional Insights by 2035

- Sealed Wax Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Wooden Pallet and Container Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Suppository Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Monodose Packaging For Probiotic and Nutraceutical Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA)

-

Plastic Dielectric Films Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.